Urgent: Cryptocurrencies are on their way down to $2 trillion…stop to go.

The Bitcoin market has entered a deep dark phase even as long-term crypto investors struggle despite resistance to last week's downtrend.

In line with the Glassnode strategists, they designed an indicator called Realized Value, which measures the normal value of bitcoins traded by investors, which is only $1,000 but equals $23,000 at the time of writing.

“The market has entered a phase that corresponds to the deepest and darkest phase of the previous phase and, on average, Bitcoin is trading above the buy price for many crypto holders and even savvy crypto investors are reversing recent declines,” he wrote in a note. .

Bitcoin is currently hovering around its lowest level since December 2020, with many newcomers taking losses.

Meanwhile, UBS strategists are eyeing bitcoin miners, whose businesses are under pressure from rising energy costs and capital spending commitments, for possible signs of capitulation, which could weigh on prices.

The risk increased as markets came under pressure after key inflation data came in higher than expected last week, suggesting the Federal Reserve may need to raise interest rates further, which could have a significant negative impact on risk assets.

Bitcoin is down 30% this month, marking the eighth straight day of decline for the cryptocurrency, with the last three-day pace of change of 21%, the biggest decline in history.

"There are many reasons why Bitcoin's rapid decline won't stop once it starts," said Brian Nick, chief investment analyst at Novin.

With the cryptocurrency losing 20% of its value in 48 hours, that means it could lose another 20% in the next few days.

Higher interest rates increase market losses

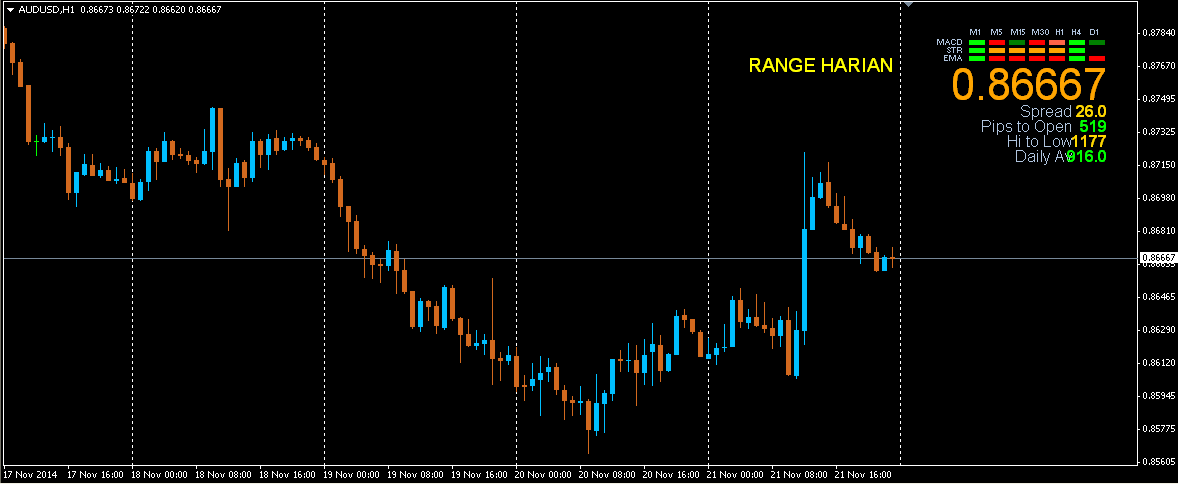

|

| Bitcoin price .. dollars |

That is why Ahmed Moati, economic analyst and CEO of VE Markets, said that with any decision to raise US interest rates, we will see the virtual currency decline, thanks to the presence of safe investment options. country. they have started raising interest rates and are expected to rise. Once in the United States.

In addition, rising inflation worldwide will cause central banks to tighten monetary policy and print less money, which suggests that if US interest rates continue to rise, we will see further declines in virtual currencies, especially since that makes sense. Most of the world's central banks expect interest rates to rise. The United States will try the same.

In addition, the return on investment activity for global projects, which shows an increase in the GDP of countries and a decrease in the unemployment rate and unemployment benefits compared to last year, with a decrease in confidence between Market Whales and "crypto" influencers such as such. Elon Musk .

Matti also acknowledged that one of the most important reasons for the increase in the value of the virtual currency market is due to the increase in money-printing countries to reduce the economic response in 2020, especially because of the difficult Corona epidemic, for what part? injected foreign money to invest in virtual currency and US stocks. And if something else happens and it stops printing money, or at least reduces the frequency of printing, it suggests that virtual currencies and US stocks will fall victim to it. 2022.

Countries around the world are also facing the worst inflation conditions in their history, as prices of goods and services continue to rise and one of the main reasons for rising inflation is the increased printing of money. The increase in interest rates in the previous point and the decline in printing currencies around the world suggest that we are facing a difficult year for virtual currencies, as they will lose two advantages that have been the direct reason for their growth in recent years. . . .

Cryptocurrencies Increase Their Losses

'Bitcoin' leads the losers' cryptocurrencies (Reuters)

The digital currency continued a wave of heavy bleeding, in the fall 'Bitcoin', which was the strongest and most widespread in the ' cryptocurrency ' market, reached a value of 21 thousand dollars, and therefore the cryptocurrency has lost more than two billion dollars. . . Less than six months ago, but the loss curve increased after two distinct signs, the first of which was the crash of stablecoin "Terra Luna" on May 9, while the opposite milestone came just days before US Inflation Data Shows an Imminent Economy. The US Federal Reserve's Interest Rate Slowdown and Expectations have raised concerns about a violent decision. This encourages investors to turn to riskier assets and protect safe-haven assets such as gold and the dollar.

In terms of trading, and compared to the best price recorded by the market last November, the collective market cap of cryptocurrencies was down 71%, losing about $2,272.3 billion, after the total market cap fell from $3.2 trillion to around 927.4 on Tuesday. tomorrow (Tuesday morning). 14 June) billion dollar jobs.

Higher interest rates increase market losses

For this reason, VE Markets economic analyst and CEO, Ahmed Moati , said that with any decision to raise US interest rates, we will see the virtual currency decline, thanks to the presence of safe investment options. countries that have started. to increase interest rates and interest rates are also expected to increase. Once in the United States.

In addition, rising inflation worldwide will cause central banks to tighten monetary policy and print less money, which suggests that if US interest rates continue to rise, we will see further declines in virtual currencies, especially since that makes sense. Most of the world's central banks expect interest rates to rise. The United States will try the same.

In addition, the return to investment activity for global projects, which is an increase in the GDP of countries and a decrease in unemployment rates and unemployment benefits compared to last year, with a decline in trust between Market Whales and "crypto" influencers like Elon Musk.

Matti also acknowledged that one of the most important reasons for the increase in the value of the virtual currency market is due to the increase in money-printing countries to reduce the economic response in 2020, especially because of the difficult Corona epidemic, for what part? injected foreign money to invest in virtual currency and US stocks. And if something else happens and it stops printing money, or at least reduces the frequency of printing, it suggests that virtual currencies and US stocks will fall victim to it. 2022.

Countries around the world are also facing the worst inflation conditions in their history, as prices of goods and services continue to rise and one of the main reasons for rising inflation is the increased printing of money. The increase in interest rates in the previous point and the decline in printing currencies around the world suggest that we are facing a difficult year for virtual currencies, as they will lose two advantages that have been the direct reason for their growth in recent years. . . .

• "Bitcoin" at a price of 21 thousand dollars

|

| bitcoin gold price |

Bitcoin has been at the forefront of cryptocurrency losses, and since hitting an all-time high last November, its value has dropped from $68,354 to around $46,361, down 67.8%. Around $21993 and their combined market value is also down. At 67.3 percent, after losing about $863.7 billion, it fell from $1,282.8 billion to about $419.1 billion, which is about 38 percent of the total market loss.

The coin "Ethereum", which ranks second on the list of the largest cryptocurrencies by market cap, posted a loss of 75.4 percent, losing about $3,568, after its price dropped from $4,732 to around $1,164 and its total market value would fall. 76.5 percent. . It lost about $459.3 billion after falling to about $140.6 billion from $599.9 billion, which is about 20.2 percent of the total market loss.

The "Tezer" coin took third place, after its price stabilized at one dollar and its market value stabilized at the level of 71.5 billion dollars and a market share of 7%.

The US dollar coin ranks fourth after its price stabilized at one dollar and its total market value stabilized at $54.1 billion, with a total market share of $5.83%. .

The BNP coin ranks 5th among the top cryptocurrencies in terms of market cap and as such the coin recorded a loss of 66%, losing around $430.0, after its price dropped from $650.9 to around $220.6 and its combined market value going down 67 ,3 percent. . The percentage loss was about $73.1 billion, from $108.6 billion to about $35.5 billion, which is about 3.2 percent of the total market loss.

Huge disadvantage of chasing major cryptocurrencies

The BUSD coin is ranked sixth, so the coin's value is stable at the one dollar level and its total market value is stable at $17.6 billion, reaching a market share of 1.89% of the total value. The coin is currently in circulation.

Ranked 7th among the 10 largest digital coins by market value, the “ Cardano ” coin posted a 19.3% loss when trading last week, versus a 0.2% gain in the last few hours. , sits at $0.477 in today's trade. . Their combined market cap was steady at $15.9 billion, reaching a market share of 1.71%.

As for the “ X Ripple ” coin, which ranks 8th out of the top 10 digital coins by market cap, it posted a 19.2 percent loss when trading last week, compared to a 5.2 loss in the last few hours. percent, to stabilize their value in today's deals, at $0.314, their combined market value also fell to the level of $15.18 billion, gaining a 1.63% market share of all the coins currently in existence. doing business

The “ Solana ” coin was ranked ninth, posting a 27.6% loss in last week's trade, down 0.7%, to settle at 28.73 in today's trade. Their combined market value fell to $9.6 billion, with a market share of 1.03%.

Dogecoin is ranked in 10th of the top 10 cryptocurrencies by market cap, posting an 8.2% loss in the last few hours, versus a 30.3% weekly loss, to be trading today at $0.552. The market price has also fallen. Together, with a size of 7.2 billion dollars, with a market share of 0.77%.

you are on a financial website, please read the article on this blog

you are on a financial website, please read the article on this blog